A case for a flexible CRM report builder for creating custom reports

When we built Saleswah CRM, first for sales and then for customer service– field service first and then for managing service centers handling repairs, functionality of our CRM reporting tool has always lagged the richness of the data that we captured.

We have been working over the past one year to change that.

The central nature of reports in your operations

Reports help you manage. They help you delve deeper into key metrics. They tell you what is working and what is not. How did our CRM reporting tool evolve with time?

Phase 1 of the CRM report builder: set of standard reports

We started with having a suite of “canned” or standard reports- reports that worked for some customers some of the time! Some measures are universal- they work for all businesses. But, most people want the reports to be tweaked, filtered and presented the way they want.

You see, reports are very unique. They are unique to your business. Because you want to measure what I in my business may not want to measure.

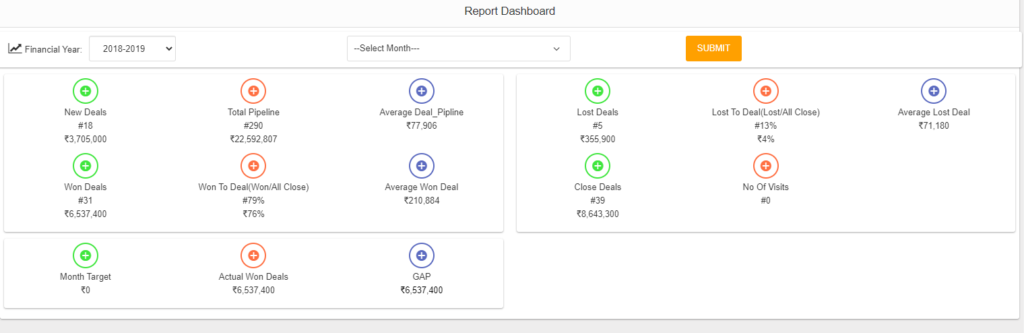

Our short term answer to this was simply build reports that anyone asked for. Even complex dashboards. Some times we built reports that made sense only to the person asking for it. But many times, the report we built on someone’s request, got added to our main product- and was available to all our customers.

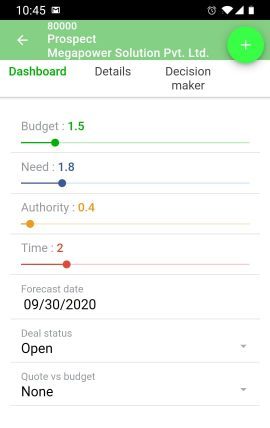

Like the “Sales Dashboard” for instance.

Phase 1 -a: CRM report builder driven by customer inputs

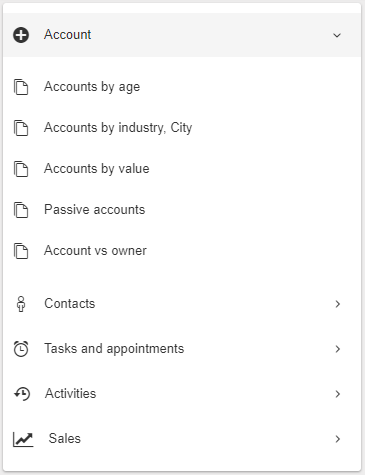

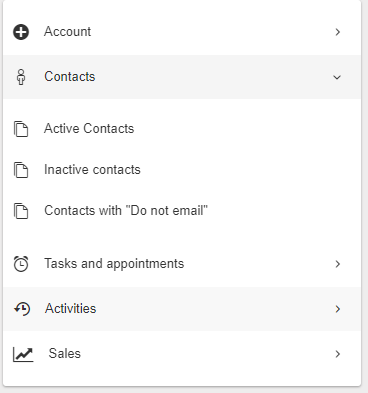

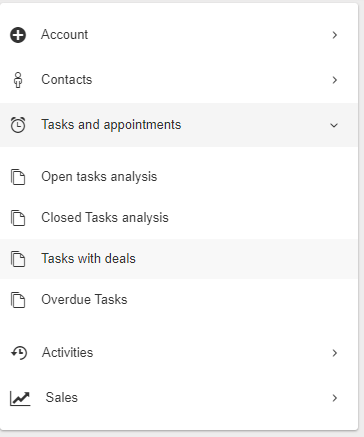

As the suite of reports grew, we organized them into folders – grouped around themes of leads, tasks, activities, deals, forecasts etc (for sales) and similarly for tickets (repair, maintenance, refuel, installation).

But, we were aiming at a target that was moving. And, in our CRM reporting tool, the module specific reports tended to be inadequate for customers who were looking for more complex analysis- how did leads distribute among industries or customer profiles? Do you close more business from marketing leads or referrals? Is there a correlation between activities and sales? Which sales guys are more productive and why?

And, we hadn’t even begun to scratch the surface of the possibilities. It’s a complex world. Some outcomes are better explained with correlation with performed activities. It’s just that what works for you, may not work for me. Even within the same industry, metrics vary widely.

So, we started looking beyond standard reports. And, explored turning the reports function over to you.

Guidelines for a CRM report builder

About a year back, this is what we drew up as design guidelines.

- Must be simple to use.

- Should not require knowledge of database structure.

- Target a power user. We spent some deliberating on this; so let me explain:

- A power user is someone who understands the full software, understands all the modules and their interplays. He also understands his own company’s business objectives, metrics and the kind of data that makes sense to senior management.

- Why not a regular user? Because, we did not think the regular user makes as much use of the software to drive his decision making. Also, a company works with a shared set of metrics- individuals don’t normally drive their own.

- Focus on flexibility in report outputs. Let the customer have control on the columns she wants to see in her report and use powerful filtering to narrow down the scope of what she wants to see.

Phase 2: Unveiling the new CRM custom report builder

While we have kept the tool simple, it is no simpler than necessary for a power user! But, if you remember your basic boolean algebra and rudiments of set theory, you should be able to work with the CRM reporting tool and generate custom reports.

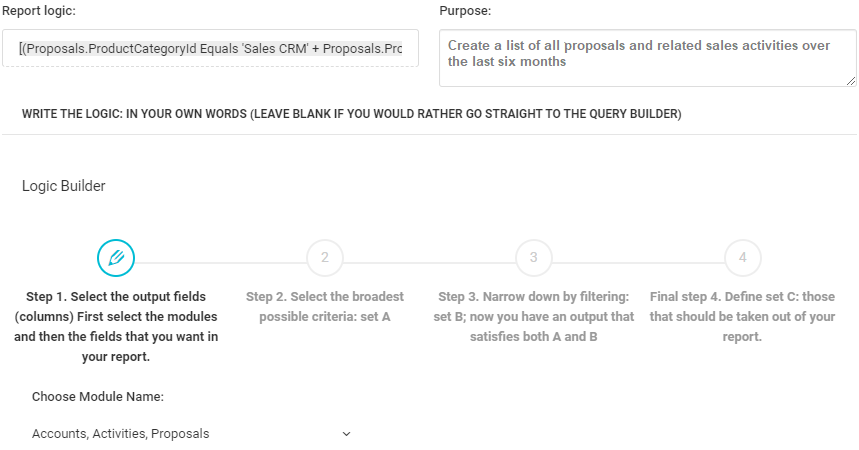

The report building wizard will help you create logic of the following type:

{(A1 + A2 + A3) AND (B1 + B2 + B3)} – (C1+C2+C3)

The idea is to build a large set of targets (A), narrow them down by filter conditions (B) and remove specific items (C) from the result.

As an example, you can expect to see a query like this below:

[(Proposals.ProductCategoryId Equals ‘Sales CRM’ + Proposals.ProductCategoryId Equals ‘Service CRM’) . (Proposals.ActivityLoggedDate LessThan ’11 Aug 2022′)] – ()

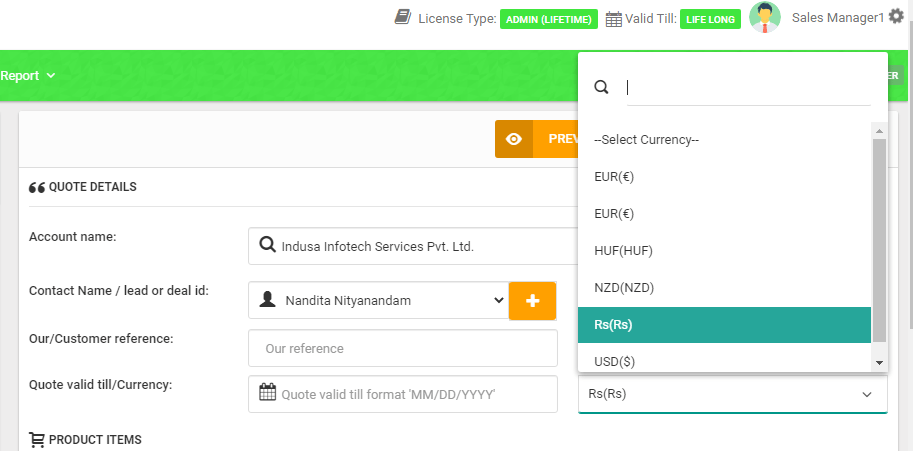

No matter if you are using a sales or service CRM, you can use the custom report builder described above to extract just the information that you need.

Export the output of the custom report builder to Google Sheets

The output of the report builder can be sent to a .csv file or exported to Google Sheets (to your connected Google Workspace).