It is not taxes but tax compliance that we fear

If you are doing business in India, then you would know this. The taxation system sucks big time.

The moment you raise a bill, you become liable to pay service tax. If the client on whom you have raised the bill, did not pay- even never- that service tax paid on a deemed income is paid to government. It will not come back.

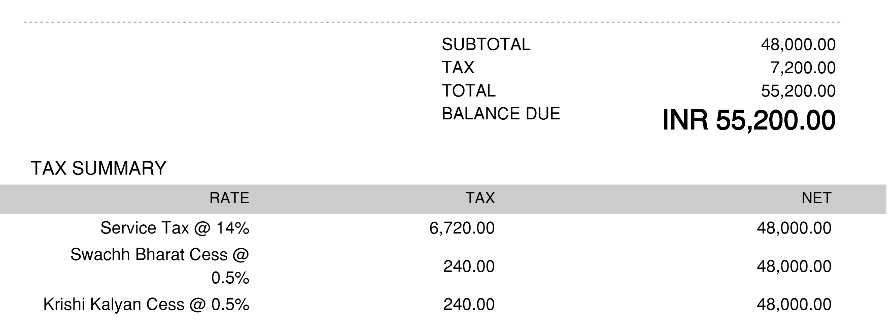

Not just that, you are liable for income tax as well. So, let us say you raised a bill for Rs 100/-. The total invoice amount is Rs 115 (counting Rs 14 as ST and 0.5% each of SBC and KKC.)

If your client paid up and promptly, he would deduct, 10% as Tax Deducted at source (TDS) and send you Rs 103.5 (90% of Rs 115)

Of which, you would deposit Rs 15 with the service tax department. So, you would have with you Rs 88.5.

You would file returns for service tax, every 6 months. For TDS (yes, you deduct as well, from your vendors and employees), every quarter. And, by the way, you would deposit the tax every month.

For a small company, that’s an awful lot of paperwork. If Mr Jaitley is looking to help the entrepreneurs, this is where he should start. Our taxation system needs reform.

What if the client does not pay?

Let’s take the extreme case of a client who simply does not pay. Ever.

You are liable to deposit the service tax on the above bill. So, instead of having Rs 88.5 in your pocket, you have a hole of Rs 15. Not just that. The government has recongnised that you had an income on which you are supposed to have paid income tax. Since no tax was deposited by your client on your behalf, you make good.

This really, really hurts.

Mr Jaitley, why make us pay service tax or income tax when we earned nothing?

The biggest weapon in the hands of the customer

When a client sits on a bill and worse, refuses to pay, he knows you are very very vulnerable. What can you do? Sue him? In India? With so many court cases dragging on for years?

The client knows he has you precisely where he wants you. By raising a bill, you are in his debt rather than the other way round!

The suggestion

My suggestion is simple. Make me pay service tax on payment realisation rather than immediately on raising the bill. So, if the client does not pay, I can write off the bad debt and move on.